The demand for data center capacity is only going to increase as more and more businesses and individuals rely on digital services. However this sudden explosion in both infrastructure development and technology delivery, has taken many within the traditional project management industry by surprise.

And while this lucrative new market appears to be a well hidden secret, it’s growing list of opportunities is basking in plain sight of those within its global sector niche.

However the list of statistics pertaining to the growth of the Data Center market do not lie. And as such, it is unlikely that this secret will be hidden for much longer.

According to leading research firm Grand View Research “The global data center market is expected to grow at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030, reaching a total market value of $764.4 billion by the close of 2030” (Grand View Research, 2024).

This astounding statistic, demonstrates the substantial growth anticipated in the data center industry.

The proliferation of data has ushered in an era of unprecedented demand for data centers. As businesses, governments, and individuals increasingly rely on digital services, the need for robust infrastructure to store and process data has skyrocketed. This surge has created a lucrative and rapidly expanding market for project managers specializing in data center development.

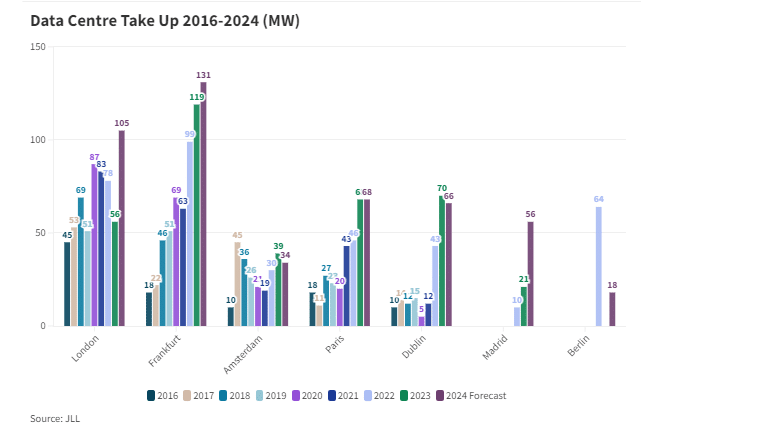

Graph from JLL EMEA Data Centre Report Q1 2024

The expansion of data centers is a global phenomenon driven by the increasing digitization of economies and the growing demand for data storage and processing capabilities.

The growth in data centers is expected to create millions of new jobs worldwide, including positions in construction, IT, operations, and management.

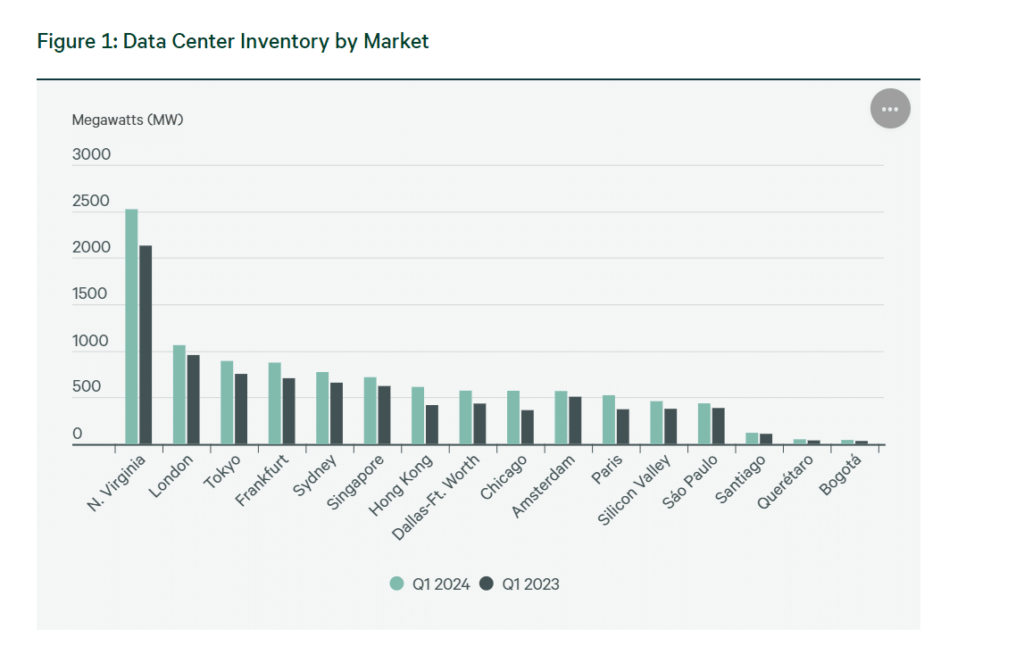

The four largest data center markets, by inventory in each global region is as follows:

North America: Northern Virginia, Dallas-FT. Worth, Chicago, and Silicon Valley.

Europe: Frankfurt, London, Amsterdam and Paris

Latin America: Queretaro (Mexico), Sao Paulo (Brazil), Santiago (Chile) and Bogota (Colombia).

Asia-Pacific: Singapore, Tokyo, Hong Kong and Sydney.

The economic impact of data center development over the next ten years is likely to impact not just those in the project management sector, but the global investor market, attracting the attention of, policymakers, and individuals seeking career opportunities in the technology sector.

Graph from CBRE Report on Global Data Center Trends 2024

Several factors are fueling the growth of data centers:

This rapid expansion has created significant opportunities for project managers.

Data center projects often involve complex technical challenges, tight deadlines, and stringent requirements. Project managers with expertise in managing large-scale infrastructure projects, IT systems, and data center technologies are in high demand.

Data centers are being developed worldwide, with regions experiencing rapid economic growth and technological advancements witnessing particularly significant activity.

Some notable Data Center mega projects to be aware of include:

As a result in 2022, the National Development and Reform Commission (NDRC) introduced a new concept called “East Data, West Computing” (东数西算). The idea is to generate data in the economically advanced and densely populated eastern regions, where digital and industrial development is high. This data is then processed in the resource-rich western regions, which have ample land and energy but lower data demand. The climate and geographical locations also make building sustainable data centers more plausible in the western regions.

To excel in data center project management, practitioners need to develop a specialized skill set:

While data center projects share some similarities with other infrastructure projects, the unique technical and operational requirements demand specialized knowledge and skills.

The data center market is highly lucrative, with significant growth potential. According to market research firm IDC, “global spending on data center infrastructure is expected to reach $200 billion by 2026”. This growth is driven by factors such as increasing digitalization, cloud adoption, and the growing volume of data.

For further information on the economic prospects and career opportunities in the Data Centre space, PMG has curated the following resources, and look out for our Digital Trend Report, which we will be publishing shortly in conjunction with Nottingham Business School. And discover more about the Atlanta initiative Project Peach, in our recent news article.

Data Reports and Whitepapers:

Government Policy Announcements, Partnerships, and Consortium Arrangements:

Specific examples of recent government policy announcements, partnerships, and consortium arrangements related to data center development include:

Swanwick House, 22 Towcester Road, Old Stratford, Milton Keynes, MK19 6AQ, UK

© 2025 Project Management Global. All rights reserved | Privacy Policy